However, please note that CRA’s current guidance on workspace in the home and employment related expenses for employees earning a salary states generally that:

The University does not provide personal tax advice to employees and individuals should consult with their personal tax advisors on this topic. It is expected that CRA will issue clarifications enabling employers to provide T2200 tax forms for the 2020 year in cases where employment contracts have not been formally amended to require employees to work from home. In cases where these requirements are met, employers can complete and provide form T2200, which employees should then maintain with their tax records.

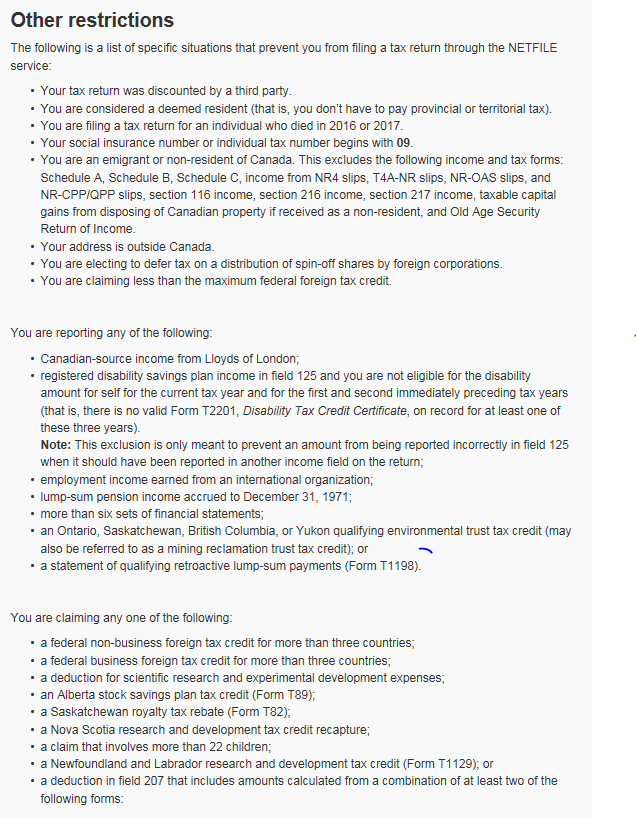

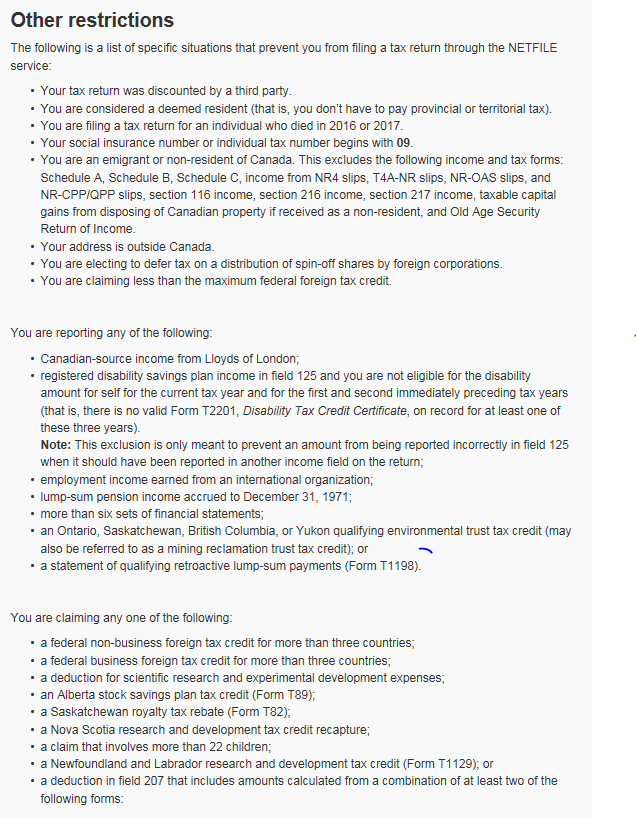

These expenses must be used directly in your work. Your employer has not reimbursed and will not reimburse you for these expenses and,. The workspace is where you mainly (more than 50% of the time) do your work. Your employment contract must require you to maintain a workspace in the home and to incur the related expenses. To deduct employment expenses related to a workspace in the home on a personal tax return, under current CRA guidelines: An update on the process for providing these forms will be provided in early 2021. Should the CRA continue to require that each employee have a T2200 form completed by their employer for calendar year 2020 to support deduction of certain expenses related to a workspace in the home, the University will provide these completed forms, as applicable, in February 2021. Due to the pandemic, the CRA will likely be reviewing and updating their guidance and administrative practices on this topic for 2020. In normal times, most UW employees do not qualify to deduct employment related expenses on their personal tax returns because the University provides the workspace and necessary equipment and supplies.

This form supports personal tax deductions for certain costs incurred by employees to carry out work remotely. If none of the responses in the list describes this person's relationship to Person 1, then specify a response under "Other relationship".Since many UW faculty and staff began working from home on March 16 th, 2020 due to the COVID-19 pandemic, questions have arisen about the University providing the Canada Revenue Agency (CRA) form T2200 Declaration of Conditions of Employment to employees for the 2020 calendar year. STEP B - Question identifier 1: Including yourself, how many persons usually live at this address on May 10, 2016? Print our name, your telephone number and the country that you represent.

the home of a government representative of another country (for example, an embassy or a high commission) and family members, mark this circle. Print your name, your telephone number and your country of residence. a dwelling occupied only by residents of another country visiting Canada (for example, on vacation or on a business trip), mark this circle. Print your name, your telephone number and your main residence address. a secondary residence (for example, a cottage) for all persons who stayed here on (all these persons have their main residence elsewhere in Canada), mark this circle. Persons in an institution for less than six months (for example, in a home for the aged, a hospital or a prison) should be listed at their usual residence. Spouses or common-law partners temporarily away who stay elsewhere while working or studying should be listed at the main residence of their family, if they return periodically. Students who return to live with their parents during the year should be included at their parents' address, even if they live elsewhere while attending school or working at a summer job. Children who spend equal time with each parent should be included in the home of the parent with whom they are staying on May 10, 2016. Children in joint custody should be included in the home of the parent where they live most of the time. Where to include persons with more than one residence Persons staying at this address temporarily on who have no main residence elsewhere. Canadian citizens, landed immigrants (permanent residents), persons asking for refugee status (refugee claimants), persons from another country with a work or study permit and family members living here with them.

All persons who have their main residence at this address on May 10, 2016, including newborn babies, room-mates and persons who are temporarily away.

0 kommentar(er)

0 kommentar(er)